The Most and Least Debt-Ridden Places in Texas

Everything is bigger in Texas, but does that mean debt is too?

Texas is one of the most affordable states in the country, with a strong economy, plentiful housing options and no state income tax. One downside to living in Texas, however, is that you pretty much have to own a car to get around, making auto loan debt a fact of life for many. Combine that with a large percentage of people paying for their education through loans, and Texans are regularly dealing with debt.

In order to rank the most debt-ridden cities in Texas, researchers looked at four different types of non-mortgage debt in 2019: student, personal, credit card and auto. We used median non-mortgage debts to rank the largest Texas cities.

- Key findings

- 15 most debt-ridden Texas cities

- 15 least debt-ridden Texas cities

- Our complete rankings

- In debt? How debt consolidation may help

- Methodology

Key findings

- Keller, a suburb of Dallas, is the most debt-ridden city in Texas. Residents carry an average $37,420 in non-mortgage debt. (Compare that to California’s most-debt ridden city, Temecula, where residents carry $30,163.) Most of Keller’s debt is due to auto loan debt. The average person has over $17,000 in auto debt.

- Pearland, a suburb outside of Houston, takes second. Pearland residents average nearly $33,000 in non-mortgage debt. Like Keller, Pearland residents rack up auto debt mostly. Auto debt accounts for more than 40% of debt in Pearland.

- At the bottom of the ranking is Lufkin. Residents here carry roughly one-third the amount of debt as residents in Keller.

- Wichita Falls comes in second from the bottom. This city has median non-mortgage debt equal to about $13,800. Roughly 40% of the average resident’s debt is from auto loans.

- Auto debt is the largest source of non-mortgage debt in all but one city (Temple) we analyzed.

- Gen Xers were the generation most likely to be the most debt-ridden. In 64 of the 71 cities we analyzed, Gen Xers were the generation with the most non-mortgage debt.

- The vast majority of people in Texas have credit card debt, but auto debt tends to be the largest source of debt. On average, about 60% of people carry auto debt, but auto debt accounts for 44% of non-mortgage debt on average. Meanwhile, about 82% of people carry credit card debt, but it accounts for only 20% of debt, on average.

- Texans are more likely to have personal loan debt. The average rate of people with personal loan debt is 37%. That’s followed by student loan debt; the average rate of people with student loan debt is 24%. Student loans tend to take up a much larger share of debt, however.

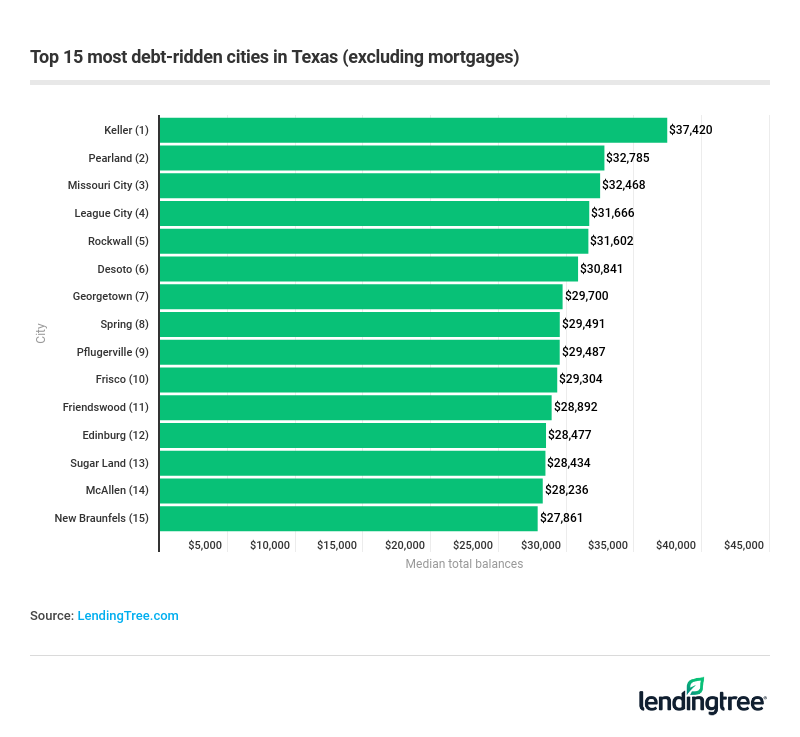

15 most debt-ridden Texas cities

The following chart shows the 15 cities in Texas whose residents carry the most non-mortgage debt. Calculations were made based on four key areas of debt: student loans, personal loans, credit card balances and auto loans.

Keller, a city of about 45,000 on the outskirts of Dallas, tops the list, with its residents carrying an average of $37,420 in non-mortgage debt. Pearland, a city outside Houston whose 126,000-plus residents have an average $32,785 in non-mortgage debt, earns the second-place slot. Rounding out the top five in descending order are Missouri City, League City and Rockwall.

Only one of Texas’s top 20 most populated cities made the list. Frisco, the 18th biggest city in Texas with a population of over 154,000, comes in 10th on the list. Residents carry an average of $29,304 in non-mortgage debt.

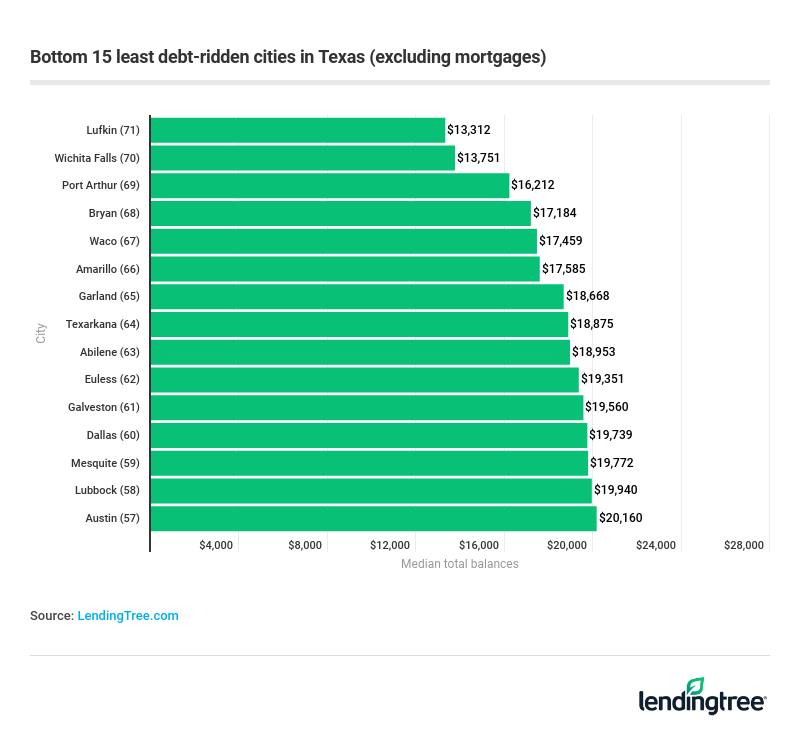

15 least debt-ridden Texas cities

This graph shows which cities in the Lone Star State are the least debt-ridden. Lufkin, a city in East Texas of about 36,000, takes the top spot here. Its residents carry an average of $13,312 of non-mortgage debt, which is almost a third of what residents of the most debt-ridden city, Keller, carry.

Wichita Falls in the North takes a close second place, with its 100,000-plus residents carrying an average of $13,751 in non-mortgage debt.

Other cities in the top five include Port Arthur, Bryan and Waco. Overall, in the top 15 least debt-ridden cities are quite a few of Texas’s biggest cities, including Amarillo, Garland, Dallas, Mesquite and Lubbock. Austin, the state’s capital, comes in 15th, with its residents carrying an average of $20,160 in non-mortgage debt.

Our complete rankings

A complete overview of what makes up the debt load of a city’s residents can be found in the below chart. It ranks all 71 cities we analyzed in order of total average non-mortgage debt load from most to least, with Keller on top and Lufkin on the bottom. Beyond that, it also shows which type of debt is earning them these slots, as well as which generation is carrying the most debt.

In every city except one (Temple), auto debt makes up the biggest portion of residents’ non-mortgage debt load. On average, about 60% of people carry auto debt, and it accounts for 44% of non-mortgage debt. Meanwhile, about 82% of people carry credit card debt, but it accounts for only 20% of their debt on average. An average of 37% of people carry personal loan debt, and 24% carry student loan debt.

When it comes to generations, there is only one city in which Baby Boomers carry the most debt — Texarkana. There, residents carry an average of $18,875 in non-mortgage debt. In six cities — Mansfield, Odessa, Carrollton, Round Rock, Galveston and Waco — Millennials carry the most non-mortgage debt, while in all the others — 64 out of 71 — it’s Gen X racking up the most.

In debt? How debt consolidation may help

No matter where you live or what your generation, you can find yourself being dragged down by debt. The most important thing is to have a plan to pay it off as quickly as possible. After all, the longer you carry that debt, the more it can cost you as interest charges accumulate. To help, one option to consider is debt consolidation.

What is debt consolidation?

Debt consolidation combines several smaller debts into one larger one. This means you can make a single payment instead of juggling multiple bills with multiple due dates.

Ideally, you’d secure an interest rate that’s lower than the individual rates of your existing debts. With a lower rate, you could reduce your overall cost of repayment.

Consolidating debt with great credit

Two of the most attractive tools to consolidate debt are personal loans and balance transfer credit cards.

Personal loans are typically simple and quick to secure as long as you have good credit and a good debt-to-income ratio. You may also be able to secure an interest rate that’s significantly lower than the interest rate on your existing debt. However, not everyone will qualify for a personal loan, and the best rates are reserved for borrowers with excellent credit.

A balance transfer credit card works much like it sounds: you transfer the balances from existing bills to one new credit card. In many cases, it will come with a low introductory interest rate — some as low as 0% — for a set period of time. This can be a great way to save on interest if you’re able to pay off the balance during that introductory period. Note that the interest rate typically jumps significantly after the introductory period.

Consolidating debt with OK credit

If you’re not eligible for a low-interest personal loan or balance-transfer credit card, two other options include secured loans and a debt management plan.

A secured loan requires some type of collateral, such as a car that has been paid off or equity in your home. Because your loan is backed by an asset, you can typically find lower rates on these products than on a personal loan. However, if you’re unable to pay off the loan, you could end up losing your collateral.

Debt management programs are offered by various companies and organizations and may help you come up with a plan to tackle your debt. That may include them negotiating lower interest rates on your behalf. Just be aware that most of these services come with a fee, which may not be worth it, and there are plenty of scammers in the field.

Don’t rush into consolidation

Before making any financial decision, make sure you’re making the best move for your money. Debt consolidation can be a great way to repay your debt for less money if you’re able to secure a lower rate on your debts and minimize fees and can avoid taking on new debt after you consolidate.

Weigh your debt consolidation options, too. This debt consolidation calculator can help you see which option, if any, might work best for you. You may also consider other strategies to getting out of debt.

Methodology

Using an anonymized sample of over 500,000 users, researchers calculated total debt balances with data from the first quarter of 2019. These results were then aggregated to the Texas cities with a population of at least 35,000 to calculate median non-mortgage debt obligation. Included in this analysis, researchers also found the average distribution of debts across the following debt types: auto, credit cards, personal loans and student.